Two weeks before December’s early signing period, Ohio State athletic director Gene Smith

released a statement describing how NIL collectives can help Buckeyes athletes and asking for more fan support.

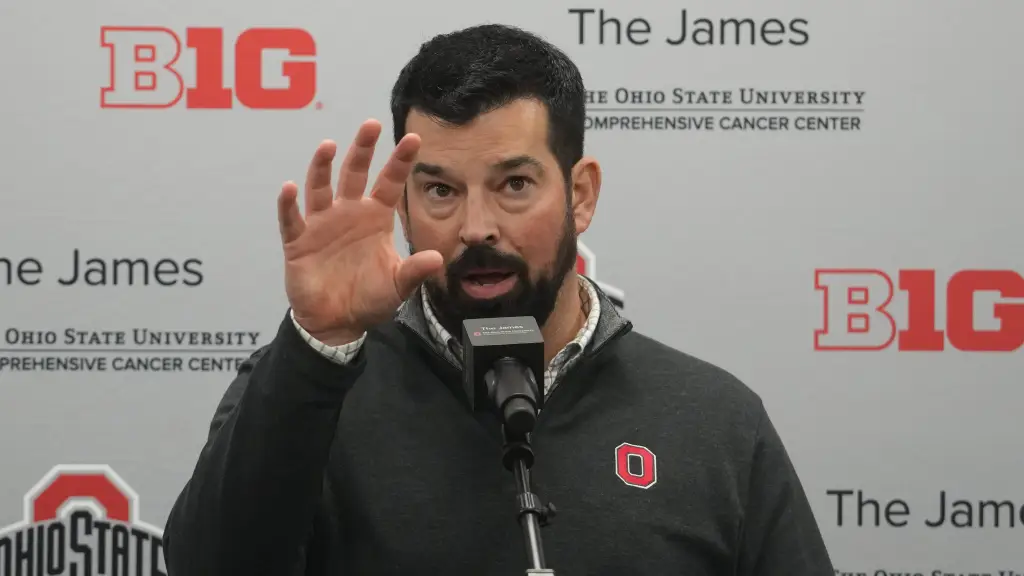

A week later, coach Ryan Day added to that statement. After being asked about how the ever-changing name, image and likeness landscape is impacting recruiting, he said it had become “the conversation” among prospects.

“As time has gone on, it’s become more and more of a priority for folks. Navigating those times is important,” Day said. “It’s a priority for us to make sure we have everything we need to support our players. We have some folks that are really helping and doing everything that they game, and that’s great, but we’ll need as much help as we can moving forward.”

In the ensuing six months, Ohio State’s NIL strategy has evolved even further. At the time of Smith’s email, he referenced The Foundation, The O Foundation and the Cohesion Foundation as Ohio State’s NIL collectives. Since then, The Foundation and O Foundation have merged and The 1870 Society, a for-profit collective, has launched with backing from Ohio State.

As the athletic department has put a higher emphasis on NIL, the people leading those collectives say they have seen a shift behind the scenes and with recruits.

“There is inertia from the entire athletic department understanding how important NIL is to the future,” said Todd Markiewicz, the president of The 1870 Society. “We are partners even though we are separate entities. You can feel from the top down that there is more of a focus on getting NIL up and running the way it should.”

Still, despite the more aggressive push by Ohio State, there’s a looming wave of uncertainty around NIL, especially when it comes to nonprofit collectives. A memo released by the IRS on June 9 said that many nonprofit collectives should no longer be deemed tax exempt, meaning those who donate would not be able to write it off on their taxes. NCAA president Charlie Baker publicly agreed with the IRS, as well.

“It’s a game-changer and potentially a game-ender,” said Gary Marcinik, president of the nonprofit Cohesion Foundation.

Is Ohio State doing everything it can in the NIL space now? And what happens if collectives aren’t allowed to have tax-exempt status?

While it looks like things have improved for Ohio State, those are complicated questions on the surface — and they will continue to linger as the Buckeyes try to get back in the win column against Michigan and compete for national championships in 2023 and beyond.